Delving into the realm of oil and gas stock market trends unveils a fascinating landscape filled with dynamic shifts and influential factors. From the current state of the market to the impact of technological innovations, this guide navigates through the intricate world of oil and gas stocks with insightful analysis and compelling insights.

As we delve deeper into the various aspects of this industry, a clearer picture emerges of how global economic factors, key players, and investment strategies play pivotal roles in shaping the trajectory of oil and gas stock market trends.

Overview of Oil and Gas Stock Market Trends

Currently, the oil and gas stock market is experiencing fluctuations influenced by various factors in the industry. Recent developments have had a notable impact on stock prices within this sector.

Key Factors Influencing Trends in the Oil and Gas Sector

- The global demand for oil and gas products plays a significant role in determining stock market trends. Any shifts in demand can directly affect stock prices.

- Geopolitical events, such as conflicts in oil-producing regions or changes in government policies, can create uncertainty and volatility in the market.

- Technological advancements in extraction methods and renewable energy sources can impact investor confidence in traditional oil and gas companies.

Recent Developments Impacting Oil and Gas Stock Prices

- The COVID-19 pandemic led to a decrease in travel and industrial activity, resulting in a sharp decline in oil prices and stock values for many companies in the sector.

- OPEC (Organization of the Petroleum Exporting Countries) decisions on production levels and quotas can have a direct impact on oil prices and stock market performance.

- Environmental regulations and the push for sustainability are increasingly influencing investor sentiment towards oil and gas companies, affecting stock prices.

Factors Affecting Oil and Gas Stock Performance

Geopolitical events, supply and demand dynamics, and environmental regulations are key factors that can significantly impact the performance of oil and gas stocks.

Geopolitical Events

Geopolitical events such as wars, conflicts, and sanctions in major oil-producing regions can disrupt the supply of oil and gas, leading to price fluctuations in the market. For example, tensions in the Middle East can cause oil prices to spike due to concerns about supply disruptions.

Supply and Demand Dynamics

The balance between supply and demand plays a crucial role in determining oil and gas stock trends. OPEC decisions on production levels, global economic growth, and changes in consumer behavior can all influence supply and demand dynamics. An oversupply of oil can lead to lower prices, while increased demand can drive prices higher.

Environmental Regulations

Environmental regulations aimed at reducing greenhouse gas emissions and promoting renewable energy sources can impact the performance of oil and gas stocks. Stricter regulations may increase operating costs for oil and gas companies, affecting their profitability and stock prices. Additionally, shifts towards cleaner energy alternatives can create uncertainty in the market and influence investor sentiment towards oil and gas stocks.

Key Players in the Oil and Gas Sector

When it comes to the oil and gas sector, there are several major companies that play a significant role in driving trends in the stock market. These companies often have a global presence and are key players in the industry.

Major Companies Driving Trends

- ExxonMobil: Known as one of the largest publicly traded oil and gas companies, ExxonMobil's performance in the stock market can heavily influence industry trends.

- Chevron Corporation: Another major player in the sector, Chevron's stock performance is closely monitored by investors and analysts for its impact on the market.

- Royal Dutch Shell: With operations across the globe, Royal Dutch Shell is a key player in the oil and gas sector, often setting benchmarks for industry performance.

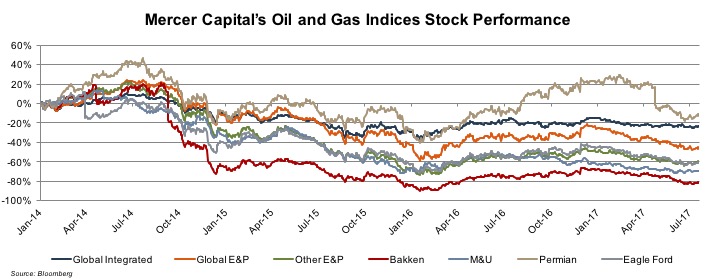

Performance Comparison

- ExxonMobil vs. Chevron: These two companies are often compared in terms of stock performance, with analysts looking at factors such as production output, reserves, and financial health to gauge their competitiveness.

- Shell vs. BP: Royal Dutch Shell and BP are also frequently compared in the stock market, with their performance impacting investor sentiment and overall industry trends.

Mergers and Acquisitions Impact

Mergers and acquisitions play a significant role in shaping the oil and gas sector, often leading to consolidation of assets and market power. When major companies merge or acquire smaller players, it can have a ripple effect on stock prices and industry dynamics.

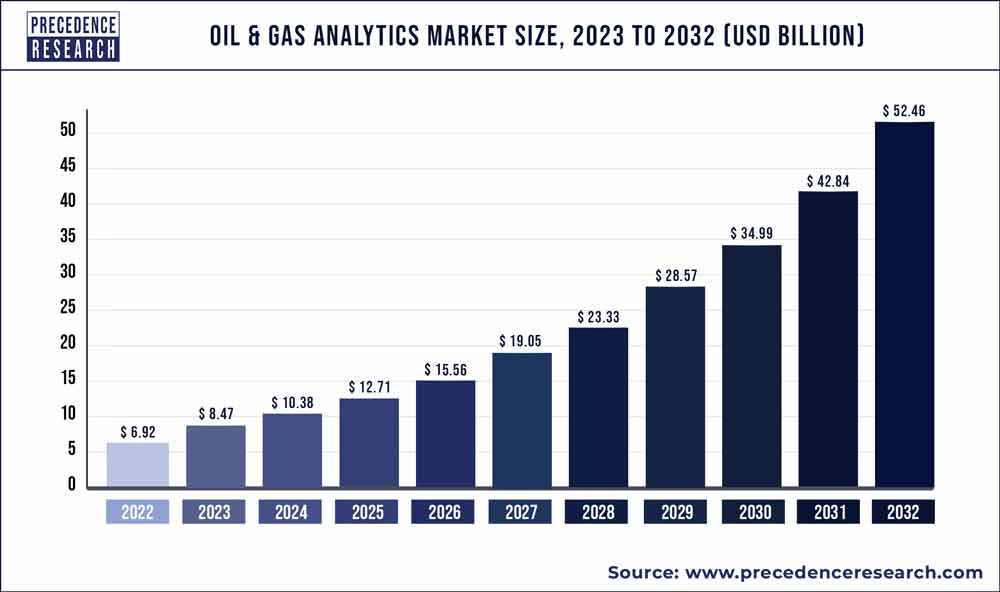

Technological Innovations in the Oil and Gas Industry

With the rapid advancements in technology, the oil and gas industry has also witnessed significant changes that are impacting stock market trends and overall operations.

Automation and Digitalization in the Oil and Gas Sector

Automation and digitalization have revolutionized the way oil and gas companies operate. By implementing advanced technologies such as Internet of Things (IoT), artificial intelligence, and robotics, companies can streamline processes, improve efficiency, and reduce operational costs. This shift towards automation and digitalization has not only enhanced productivity but also increased safety measures in the industry.

Impact of Renewable Energy on Traditional Oil and Gas Companies

The rise of renewable energy sources like solar, wind, and hydropower has posed a challenge to traditional oil and gas companies. As the world moves towards a more sustainable future, there is a growing demand for cleaner energy alternatives. This shift has forced oil and gas companies to reevaluate their business models and invest in renewable energy projects to stay competitive in the market.

Companies that fail to adapt to this changing landscape may face declining stock performance in the long run

Global Economic Factors Impacting Oil and Gas Stocks

Global economic trends play a crucial role in influencing the performance of oil and gas stocks. The relationship between these economic factors and the stock market can have significant implications for investors. Let's delve into how various global economic factors impact oil and gas stocks.

Oil Prices and Economic Indicators

The price of oil is closely linked to various economic indicators such as GDP growth, inflation rates, and interest rates. When the global economy is booming, there is typically an increased demand for oil, leading to higher oil prices. On the other hand, during economic downturns, the demand for oil decreases, causing oil prices to fall.

Investors closely monitor these economic indicators to gauge the future performance of oil and gas stocks.

Currency Fluctuations and Oil and Gas Stock Prices

Currency fluctuations can also have a significant impact on oil and gas stock prices. Oil is traded globally in U.S. dollars, so any fluctuations in currency exchange rates can affect the cost of oil production and transportation. A strong U.S.

dollar can make oil more expensive for countries using other currencies, leading to a decrease in demand and ultimately affecting oil and gas stock prices. Investors need to consider these currency fluctuations when analyzing the performance of oil and gas stocks in the market.

Investment Strategies for Oil and Gas Stocks

Investing in oil and gas stocks can be a lucrative opportunity for investors looking to diversify their portfolios. However, it's essential to have a solid investment strategy in place to navigate the complexities of the oil and gas sector.

Choosing Oil and Gas Stocks

When evaluating and choosing oil and gas stocks for investment, consider factors such as the company's financial health, production levels, reserves, and exploration activities. Look for companies with a strong track record of profitability and a solid growth strategy in place.

- Assess the company's management team and their experience in the industry.

- Look at the company's debt levels and cash flow to ensure financial stability.

- Consider geopolitical risks and regulatory challenges that could impact the company's operations.

Diversification Strategies

Diversification is key when building a portfolio that includes oil and gas stocks. By spreading your investments across different companies within the sector, as well as other industries, you can reduce risk and protect your overall investment.

- Invest in a mix of oil and gas exploration, production, and service companies to diversify your exposure.

- Consider adding energy ETFs or mutual funds to your portfolio to gain broad exposure to the sector.

- Include other industries like technology, healthcare, or consumer goods to further diversify your portfolio.

Risk Factors in the Oil and Gas Sector

Investing in the oil and gas sector comes with its own set of risks, including commodity price volatility, geopolitical instability, regulatory changes, and environmental concerns. It's crucial to be aware of these risks and incorporate risk management strategies into your investment approach.

- Monitor global oil and gas supply and demand dynamics to stay informed about market trends.

- Stay updated on regulatory changes and environmental initiatives that could impact the sector.

- Diversify your portfolio across different industries to mitigate the impact of sector-specific risks.

Epilogue

In conclusion, the dynamic nature of oil and gas stock market trends presents both challenges and opportunities for investors and industry players alike. By understanding the key factors influencing this sector and staying informed about the latest developments, one can navigate this volatile market with confidence and strategic acumen.

Questions Often Asked

What are some key factors influencing oil and gas stock market trends?

Factors such as geopolitical events, supply and demand dynamics, and environmental regulations play significant roles in shaping oil and gas stock prices.

How do technological innovations impact the oil and gas stock market?

Technological advancements, including automation and digitalization, are reshaping the oil and gas sector and influencing stock market trends.

Why is it important to diversify a portfolio including oil and gas stocks?

Diversification helps mitigate risk by spreading investments across different assets, reducing exposure to the volatility of any single stock.

How do global economic factors affect oil and gas stock market performance?

Global economic trends, oil prices, and currency fluctuations all have significant impacts on the performance of oil and gas stocks in the market.