Diving into the world of Forex Market Live Rates & Trading Strategies, this introduction sets the stage for an insightful discussion on the dynamics of currency trading.

Providing a comprehensive overview of live rates and trading strategies, this content aims to equip readers with essential knowledge to navigate the Forex market effectively.

Overview of Forex Market Live Rates

Forex market live rates refer to the real-time prices of currency pairs that are constantly changing based on supply and demand in the global foreign exchange market. These rates are determined by various factors such as economic indicators, geopolitical events, and market sentiment.

Major Currency Pairs and Current Live Rates

Some of the major currency pairs in the Forex market include:

- Euro to US Dollar (EUR/USD) - 1.1750

- British Pound to US Dollar (GBP/USD) - 1.3850

- US Dollar to Japanese Yen (USD/JPY) - 109.50

Importance of Staying Updated with Live Rates for Forex Trading

It is crucial for Forex traders to stay updated with live rates as they directly impact the profitability of trades. By monitoring live rates, traders can make informed decisions about when to enter or exit positions, manage risk effectively, and capitalize on trading opportunities.

Differences Between Live Rates and Delayed Rates

Live rates provide real-time information on currency prices, allowing traders to react quickly to market changes. On the other hand, delayed rates are not updated in real-time and may not reflect the current market conditions accurately. Traders relying on delayed rates may miss out on profitable opportunities or face increased risk due to outdated information.

Trading Strategies in the Forex Market

Having a well-defined trading strategy is crucial for success in the Forex market. It helps traders make informed decisions, manage risks effectively, and stay disciplined in their approach.

Common Forex Trading Strategies

- Day Trading: Involves opening and closing positions within the same trading day to take advantage of short-term price movements.

- Swing Trading: Traders hold positions for several days or weeks to capitalize on medium-term market trends.

- Trend Following: Based on identifying and following the prevailing market trends to enter trades in the direction of the trend.

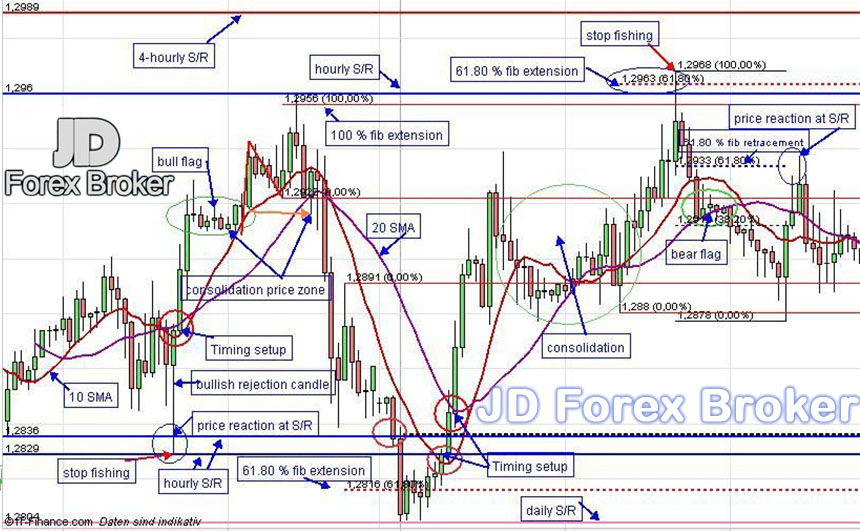

- Range Trading: Involves identifying support and resistance levels to trade within a specific price range.

Significance of Trading Strategies

A trading strategy provides a structured approach to trading, helping traders remain focused on their goals and avoid impulsive decisions. It also assists in risk management and maintaining consistency in trading.

Technical Analysis Tools

- Moving Averages: Used to identify trends and potential entry/exit points based on the average price over a specific period.

- RSI (Relative Strength Index): Indicates overbought or oversold conditions in the market, helping traders identify potential reversal points.

- Fibonacci Retracement: Helps identify potential support and resistance levels based on the Fibonacci sequence.

Role of Fundamental Analysis

Fundamental analysis involves assessing economic indicators, geopolitical events, and market news to gauge the overall health of a currency. It helps traders make informed decisions based on the underlying factors affecting currency values.

Factors Influencing Forex Market Live Rates

When it comes to the fluctuations in live Forex rates, there are several key factors that play a significant role in influencing these changes. Understanding these factors is crucial for anyone involved in Forex trading.

Economic Indicators

Economic indicators such as GDP growth, employment rates, and manufacturing output can have a direct impact on currency exchange rates. For example, if a country's GDP growth exceeds expectations, its currency may strengthen as it indicates a strong economy.

- Positive employment data can lead to an increase in a country's currency value as it suggests a healthy job market.

- On the other hand, a decline in manufacturing output might result in a decrease in the value of the currency.

Geopolitical Events

Geopolitical events such as elections, wars, and trade agreements can also affect Forex market live rates. These events can create uncertainty in the market, leading to fluctuations in currency values.

- For instance, a country facing political instability may see its currency depreciate due to the perceived risk by investors.

- Trade agreements can positively or negatively impact a currency depending on the terms and conditions agreed upon.

Interest Rates and Inflation

Interest rates and inflation are crucial factors that influence currency values. Central banks often adjust interest rates to control inflation, which in turn affects the exchange rates of a currency.

- Higher interest rates in a country can attract foreign investors looking for better returns on their investments, leading to an appreciation of the currency.

- On the other hand, high inflation rates can erode the purchasing power of a currency, causing its value to decrease.

Risk Management in Forex Trading

Effective risk management is crucial in Forex trading to protect your capital and minimize potential losses. By implementing proper risk management techniques, traders can increase their chances of long-term success in the volatile Forex market.

Different Risk Management Techniques

Forex traders employ various risk management strategies to safeguard their investments. Some common techniques include:

- Setting stop-loss orders to limit potential losses

- Using proper position sizing to control risk exposure

- Diversifying investments to spread risk across multiple currency pairs

- Implementing risk-reward ratios to ensure potential profits outweigh potential losses

Stop-Loss Orders and Their Significance

Stop-loss orders are essential tools in risk management as they automatically close a trade at a predetermined price level to prevent further losses. By setting stop-loss orders, traders can define their risk tolerance and protect their capital from significant drawdowns.

For example, if a trader enters a long position on EUR/USD at 1.2000 and sets a stop-loss order at 1.1950, the trade will automatically close if the price reaches 1.1950, limiting the potential loss to 50 pips.

Minimizing Losses with Risk Management Strategies

Implementing effective risk management strategies can help traders minimize losses in Forex trading. By combining techniques like stop-loss orders, proper position sizing, and risk-reward ratios, traders can protect their capital and preserve their profits in the face of market volatility.

Last Recap

In conclusion, understanding the intricacies of Forex Market Live Rates & Trading Strategies is crucial for success in the ever-evolving world of currency trading.

FAQ Insights

What are Forex market live rates and how are they determined?

Forex market live rates are real-time prices of currencies in the foreign exchange market, determined by the interplay of supply and demand.

Why is it important to stay updated with live rates for Forex trading?

Staying updated with live rates is crucial as it helps traders make informed decisions based on the most recent market conditions.

How do economic indicators influence currency exchange rates?

Economic indicators such as GDP, employment data, and inflation rates can impact currency exchange rates by signaling the health of a country's economy.

What is the significance of risk management in Forex trading?

Risk management in Forex trading is essential to protect capital and minimize losses, ensuring long-term profitability for traders.

How can risk management strategies help minimize losses in Forex trading?

Risk management strategies like setting stop-loss orders and position sizing can help limit potential losses and protect investments in Forex trading.