Navigating through the dynamic landscape of Commodity Market Trends: Latest Insights & Forecasts, this paragraph sets the stage for a compelling exploration, drawing readers into a world of intriguing developments and future forecasts.

The subsequent paragraph delves into the essence of the topic, providing informative details and analysis.

Overview of Commodity Market Trends

Commodity market trends refer to the patterns and movements in the prices of various raw materials and primary agricultural products that are actively traded in the market. These trends are influenced by a variety of factors, including supply and demand dynamics, geopolitical events, weather conditions, and global economic indicators.

It is essential to stay updated on commodity market trends as they can have a significant impact on various industries and economies around the world. Understanding these trends can help businesses, investors, and policymakers make informed decisions regarding production, investment, and trade.

Examples of Commodities Commonly Traded in the Market

- Crude Oil: One of the most widely traded commodities, crude oil is essential for various industries and is influenced by global demand, production levels, and geopolitical events.

- Gold: A popular safe-haven asset, gold is traded for its value as a store of wealth and is influenced by factors such as inflation, interest rates, and economic uncertainty.

- Corn: A key agricultural commodity, corn is used in food production, animal feed, and biofuels. Its price is affected by weather conditions, crop yields, and global demand.

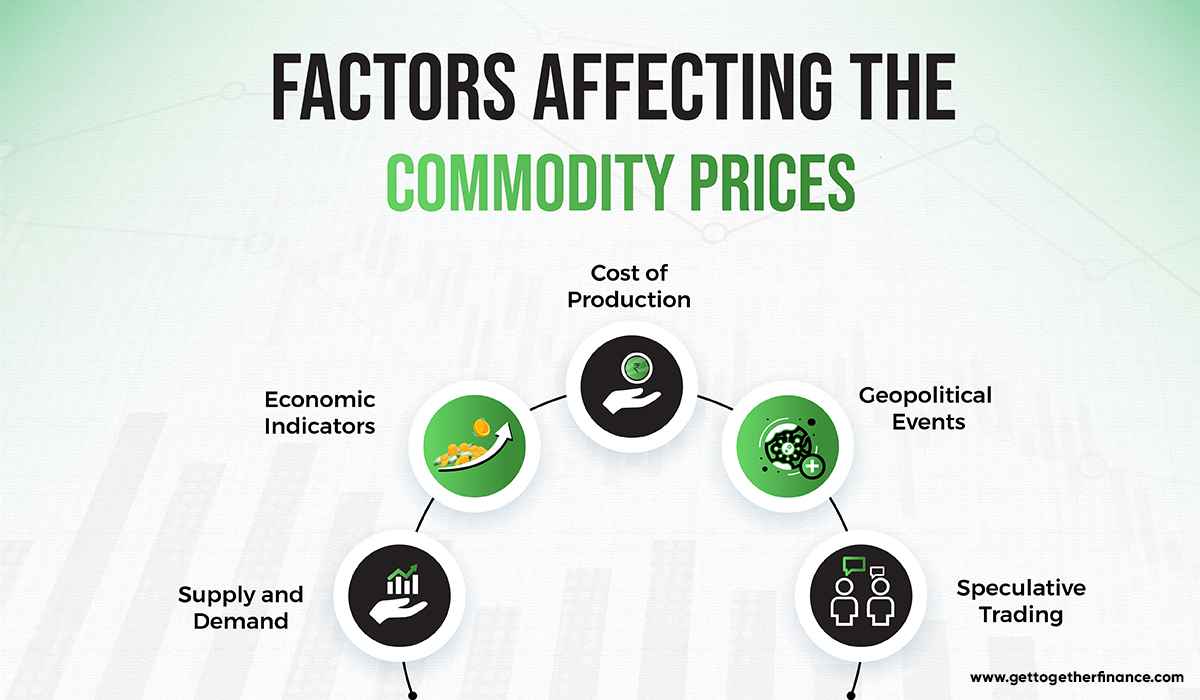

Factors Influencing Commodity Market Trends

Commodity market trends are influenced by a variety of factors that can impact prices and market dynamics. Understanding these key factors is essential for investors and traders to make informed decisions in the market.

Geopolitical Events and Commodity Prices

Geopolitical events play a significant role in shaping commodity market trends. Any political instability, conflicts, trade disputes, or sanctions in major commodity-producing regions can disrupt the supply chain and affect prices. For example, tensions in the Middle East can lead to spikes in oil prices, impacting the global energy market.

Supply and Demand Dynamics in Market Trends

The fundamental economic principles of supply and demand are crucial in shaping commodity market trends. When the demand for a particular commodity exceeds the available supply, prices tend to rise. Conversely, an oversupply can lead to price declines. Factors such as weather conditions, technological advancements, and changing consumer preferences can all influence supply and demand dynamics in commodity markets.

Recent Developments in Commodity Markets

The commodity markets have seen significant shifts and changes in recent times, influenced by various factors such as technological advancements and evolving consumer preferences. These developments have reshaped the landscape of commodity trading and opened up new opportunities for investors and traders alike.

Impact of Technological Advancements on Commodity Trading

Technological advancements, particularly in the field of digitalization and automation, have revolutionized commodity trading. The use of algorithms and artificial intelligence has enabled more efficient and accurate trading decisions, reducing human error and increasing the speed of transactions. This has led to a more streamlined and transparent market, benefiting both buyers and sellers.

New Commodities Gaining Popularity

In addition to traditional commodities like gold, oil, and agricultural products, new commodities have been gaining popularity in the market

Similarly, sustainable commodities like carbon credits and renewable energy certificates have seen increased demand as consumers become more environmentally conscious.

Forecasting Future Trends in Commodity Markets

Predicting future trends in commodity markets is a crucial aspect of making informed decisions in the trading world. Various methods are utilized to forecast these trends, each with its own set of challenges and considerations. Additionally, macroeconomic indicators play a significant role in influencing and shaping the direction of commodity market trends.

Methods Used for Forecasting Commodity Market Trends

- Technical Analysis: This method involves analyzing historical price data and market statistics to identify patterns and trends that can help predict future price movements.

- Fundamental Analysis: By examining supply and demand factors, geopolitical events, weather patterns, and other external factors, fundamental analysis helps traders make informed predictions about future price movements.

- Sentiment Analysis: This approach involves gauging market sentiment and investor behavior to anticipate shifts in market trends based on emotional and psychological factors.

Challenges in Predicting Commodity Prices

- Volatility: Commodity markets are inherently volatile, making it difficult to accurately predict price movements with certainty.

- External Factors: Geopolitical events, natural disasters, and other external factors can significantly impact commodity prices, adding complexity to forecasting.

- Market Speculation: Speculative trading and market manipulation can distort price trends, making it challenging to predict future movements accurately.

Role of Macroeconomic Indicators in Forecasting Market Trends

- GDP Growth: Economic growth rates can provide insights into the demand for commodities, influencing future price trends.

- Interest Rates: Changes in interest rates can impact the cost of borrowing and investment decisions, affecting commodity prices.

- Inflation Rates: Inflation can erode purchasing power and impact consumer demand for commodities, thereby influencing market trends.

Final Wrap-Up

Concluding with a captivating summary, this section encapsulates the key points discussed, leaving readers with a lasting impression of the insights shared.

Question & Answer Hub

What are commodity market trends?

Commodity market trends refer to the patterns and changes in the prices and demand for various raw materials or agricultural products traded on the market.

How do geopolitical events impact commodity prices?

Geopolitical events can influence commodity prices by disrupting supply chains, affecting production, or creating uncertainty in global markets.

What are some new commodities gaining popularity in the market?

Some new commodities gaining popularity include lithium for electric vehicle batteries and rare earth metals for technology manufacturing.