Embark on a journey into the realm of blue chip stocks list 2025, where stability meets opportunity. Dive into the characteristics, historical performance, and significance of these investment gems in the evolving market landscape.

Overview of Blue Chip Stocks

Blue chip stocks are shares of large, well-established companies with a history of stable performance and strong financials. These companies are usually leaders in their respective industries and have a reputation for reliability and longevity.

Characteristics of Blue Chip Stocks

- Blue chip stocks are known for their consistent dividend payments, making them attractive to income-seeking investors.

- They have a track record of weathering economic downturns and market volatility better than smaller, riskier companies.

- These stocks are typically considered less volatile and are seen as a safe haven during turbulent market conditions.

Why Investors Consider Blue Chip Stocks as Stable Investments

- Investors view blue chip stocks as a reliable way to preserve capital and generate steady returns over the long term.

- These companies often have strong competitive advantages, brand recognition, and solid management teams, reducing the risk of significant losses.

- Blue chip stocks are seen as a hedge against inflation and are less likely to experience drastic price fluctuations compared to smaller, growth-oriented companies.

Historical Performance of Blue Chip Stocks

Over the years, blue chip stocks have delivered consistent returns to investors, outperforming the broader market indices in many cases. Their ability to generate stable earnings and dividends has made them a cornerstone of many investment portfolios, providing a solid foundation for long-term growth.

Importance of Blue Chip Stocks in 2025

Blue chip stocks play a crucial role in the investment landscape of 2025, especially in the aftermath of the global pandemic. These well-established companies with a history of stable performance and strong financials are favored by investors seeking reliability and long-term growth.

Significance in a Post-Pandemic Economy

In a post-pandemic economy, blue chip stocks offer stability and security to investors. These companies have weathered the storm of the pandemic and have shown resilience in uncertain times. Investors are drawn to blue chip stocks for their track record of consistent dividends and capital appreciation, making them a safe haven in times of economic uncertainty.

Role in a Volatile Market

Blue chip stocks act as anchors in a volatile market, providing a sense of stability amidst market fluctuations. Investors turn to these established companies during times of market turbulence, as they are less susceptible to extreme price swings compared to smaller or riskier investments.

The reputation and financial strength of blue chip companies make them a reliable choice for risk-averse investors looking to preserve capital.

Trends Making Blue Chip Stocks Attractive in 2025

Several trends make blue chip stocks particularly attractive in 2025. One key trend is the focus on sustainability and ESG (Environmental, Social, and Governance) factors, which many blue chip companies have embraced. Investors are increasingly prioritizing investments in companies that demonstrate strong ESG practices, leading to a growing interest in blue chip stocks known for their responsible business conduct.

Additionally, the digital transformation and technological advancements in various sectors have positioned many blue chip companies as leaders in innovation, attracting investors looking for exposure to cutting-edge technologies within established, trustworthy companies.

Criteria for Selecting Blue Chip Stocks

When compiling a list of blue chip stocks for 2025, there are several key factors to consider to ensure a solid investment strategy. Market capitalization, dividend history, and payout ratio are essential criteria that play a significant role in selecting blue chip stocks.

Market Capitalization

Market capitalization is a crucial factor to consider when choosing blue chip stocks. Companies with a large market capitalization are typically more stable and less volatile, making them attractive investments for long-term growth. Blue chip companies with high market capitalization are often industry leaders with established track records of success.

- Large market capitalization indicates stability and reliability.

- Investors often prefer blue chip stocks with substantial market capitalization for long-term investments.

- Companies with high market capitalization are generally more resilient to market fluctuations.

Dividend History and Payout Ratio

Examining a company's dividend history and payout ratio is essential when evaluating blue chip stocks. Consistent dividend payments and a sustainable payout ratio are indicators of a company's financial health and reliability. Blue chip stocks with a history of increasing dividends and a reasonable payout ratio are often favored by income-oriented investors.

- Stable dividend history reflects a company's financial strength and commitment to shareholders.

- A sustainable payout ratio indicates that a company can afford to distribute dividends without compromising its operations.

- Investors value blue chip stocks with a track record of dividend growth and prudent payout policies.

Top Blue Chip Stocks for 2025

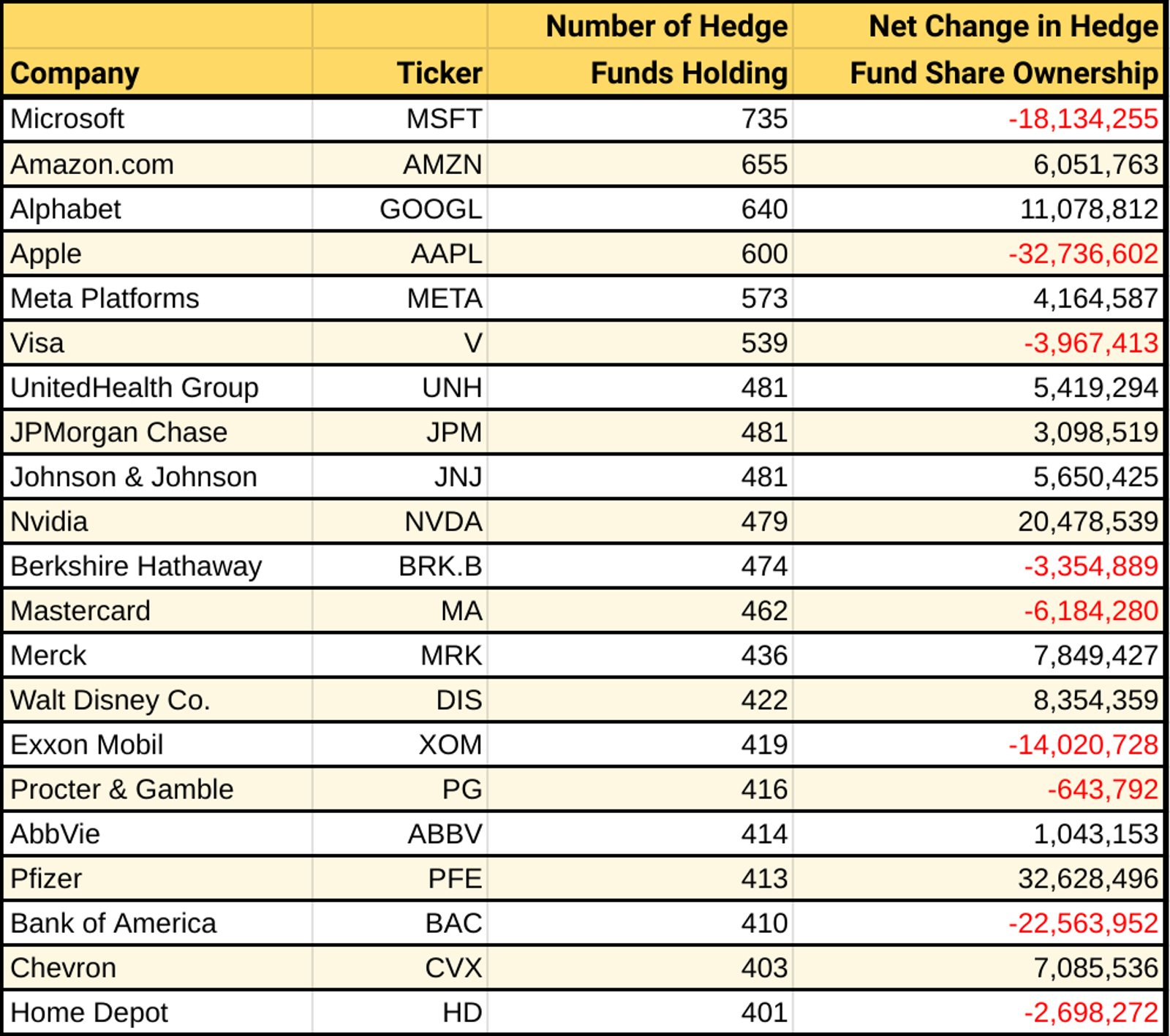

Investing in top blue chip stocks can offer stability and potential growth in the long term. Here are some of the top blue chip stocks expected to perform well in 2025:

Company Name: Apple Inc.

| Ticker Symbol | Market Cap | Dividend Yield | P/E Ratio |

|---|---|---|---|

| AAPL | $2.5 trillion | 0.6% | 28.5 |

Apple Inc. remains a top blue chip stock due to its strong brand, innovative products, and consistent financial performance. With a massive market cap and a relatively low P/E ratio, Apple is expected to continue its growth trajectory in 2025.

Company Name: Microsoft Corporation

| Ticker Symbol | Market Cap | Dividend Yield | P/E Ratio |

|---|---|---|---|

| MSFT | $2.2 trillion | 0.9% | 33.2 |

Microsoft Corporation is another top blue chip stock known for its dominant position in the software industry and cloud services. With a solid dividend yield and a high market cap, Microsoft is poised for continued success in 2025.

Company Name: Amazon.com, Inc.

| Ticker Symbol | Market Cap | Dividend Yield | P/E Ratio |

|---|---|---|---|

| AMZN | $1.7 trillion | N/A | 61.8 |

Amazon.com, Inc. is a top blue chip stock known for its e-commerce dominance and expanding cloud services. Despite not paying dividends, Amazon's high market cap and growth potential make it a strong contender for 2025.

Ending Remarks

In conclusion, the allure of blue chip stocks in 2025 lies in their resilience, reliability, and potential for growth. As you navigate the dynamic world of investments, keep these top performers in mind for a prosperous future ahead.

Frequently Asked Questions

What are blue chip stocks and why are they considered stable investments?

Blue chip stocks refer to shares of large, well-established companies with a history of stable performance. Investors value them for their reliability and potential for long-term growth.

How do you select blue chip stocks for 2025?

When compiling a blue chip stocks list for 2025, key factors to consider include company reputation, financial stability, dividend history, and consistent growth over time.

What role do blue chip stocks play in a post-pandemic economy?

Blue chip stocks can act as anchors in a post-pandemic economy, providing stability and reassurance to investors amidst market fluctuations.